- Businesses

- Ebonyi, Nigeria

FIDELITY BANK PLC (AFIKPO BRANCH) EBONYI STATE

About

Fidelity Bank is a full-fledged commercial bank operating in Nigeria, with over 7.2 million customers who are serviced across its 250 business offices and various other digital banking channels.

Focused on select niche corporate banking sectors as well as Micro Small and Medium Enterprises (MSMEs), Fidelity Bank is rapidly implementing a digital based retail banking strategy which has resulted in exponential growth in savings deposits over the last 12 years, with over 57 percent customer enrollment on the Bank’s flagship mobile/internet banking products.

Quoted on the Nigerian Stock Exchange (NSE), Fidelity Bank Plc began operations in 1988 as a Merchant Bank. In 1999, it converted to Commercial Banking and then became a Universal Bank in February 2001. The current enlarged Fidelity Bank is a result of the merger with the former FSB International Bank Plc and Manny Bank Plc in 2005.

Key Milestones:

1988: Established as a merchant bank.

1999: Transitioned to a commercial bank.

2001: Became a universal bank.

2005: Merged with FSB International Bank Plc and Manny Bank Plc to expand operations.

2020s: Focus on digital transformation and SME banking.

Vision Statement

“To be number one in every market we serve and for every branded product we offer.”

Mission Statement

“To make financial services easy and accessible to our customers.”

Core Values

- C > Customer First

- R > Respect

- E > Excellence

- S > Shared Ambition

- T > Tenacity

Historical Background of Fidelity Bank Plc, Nigeria

Fidelity Bank Plc is one of Nigeria’s leading financial institutions, renowned for its innovative banking solutions, customer-centric approach, and significant contributions to the Nigerian economy. Since its inception in 1988, the bank has evolved from a merchant bank to a full-fledged commercial bank, leveraging strategic mergers, digital transformation, and a focus on customer satisfaction to become a key player in Nigeria’s banking sector.

Founding and Early Years (1988 – 1999)

Fidelity Bank Plc was established in 1988 as a merchant bank, primarily focusing on corporate finance, investment banking, and trade services. During this period, the bank catered to the needs of corporate clients, providing specialized financial solutions such as project financing, advisory services, and capital market operations. Its early years were marked by a commitment to professionalism, integrity, and excellence, which laid the foundation for its future growth.

In 1999, Fidelity Bank underwent a significant transformation, transitioning from a merchant bank to a commercial bank. This shift allowed the bank to expand its services to include retail banking and business banking, enabling it to serve a broader customer base, including individuals, small and medium-sized enterprises (SMEs), and large corporations. This strategic move positioned Fidelity Bank to take advantage of the growing demand for accessible and inclusive financial services in Nigeria.

Expansion and Growth (2000 – 2010)

The early 2000s marked a period of rapid expansion and growth for Fidelity Bank. In 2001, the bank became a universal bank, offering a full range of financial services, including retail banking, corporate banking, and investment banking. This transition enabled Fidelity Bank to compete effectively in Nigeria’s dynamic banking industry.

A major milestone in the bank’s history occurred in 2005 when it merged with FSB International Bank Plc and Manny Bank Plc. This merger significantly increased Fidelity Bank’s branch network, customer base, and market share, solidifying its position as one of Nigeria’s top 10 banks in terms of assets and deposits. The merger also enhanced the bank’s operational efficiency and strengthened its ability to deliver innovative financial solutions to its customers.

During this period, Fidelity Bank focused on building a strong brand identity, emphasizing customer satisfaction, financial inclusion, and corporate social responsibility. The bank’s commitment to excellence earned it recognition as a trusted financial partner for individuals, businesses, and institutions across Nigeria.

Digital Transformation and Market Leadership (2011 – Present)

From the 2010s onward, Fidelity Bank embarked on a journey of digital transformation, leveraging technology to enhance customer experience and streamline its operations. The bank launched several digital banking platforms, including online banking, a mobile banking app, and USSD banking, enabling customers to access banking services conveniently from their devices. These innovations have positioned Fidelity Bank as a leader in Nigeria’s digital banking space.

Fidelity Bank has also been at the forefront of SME financing, providing tailored financial solutions to support the growth of small and medium-sized enterprises, which are the backbone of Nigeria’s economy. The bank’s commitment to corporate banking and retail banking has further strengthened its reputation as a reliable financial institution.

Today, Fidelity Bank boasts a network of over 250 business offices and serves more than 5 million customers nationwide. The bank continues to expand its reach, offering a wide range of products and services, including savings accounts, loans, investment opportunities, and wealth management solutions.

Key Milestones in Fidelity Bank’s History

- 1988: Fidelity Bank is established as a merchant bank.

- 1999: Transition from a merchant bank to a commercial bank.

- 2001: Becomes a universal bank, offering full-scale financial services.

- 2005: Merges with FSB International Bank Plc and Manny Bank Plc.

- 2010s: Embarks on digital transformation, launching online and mobile banking platforms.

- Present: Operates over 250 business offices and serves 5 million customers.

Key Achievements:

- Consistently ranked among Nigeria’s leading banks.

- Strong focus on SME banking and financial inclusion.

- Growth in digital banking and fintech collaborations.

Banks That Merged with Fidelity Bank Plc

In 2005, Fidelity Bank Plc expanded its operations by merging with the following banks:

- FSB International Bank Plc

- Manny Bank Plc

This merger significantly increased Fidelity Bank’s customer base, asset portfolio, and branch network, positioning it among the top 10 banks in Nigeria at the time. The merger also strengthened the bank’s retail, corporate, and SME banking services.

Current Status

As of February 2025, Fidelity Bank Plc continues to strengthen its position in Nigeria’s banking sector through strategic initiatives and robust financial performance.

Financial Performance:

-

Capital Raising:

In early 2025, Fidelity Bank successfully concluded the first phase of its equity capital raise, achieving an impressive 238% oversubscription in its public offer. This effort raised a total of ₦272.51 billion, significantly boosting the bank’s capital base.

-

Profit Growth:

The bank reported a 120.1% increase in profit, reaching ₦39.5 billion in the first quarter of 2024, reflecting strong operational efficiency and market confidence.

Operational Expansion:

-

Customer Base and Reach:

Fidelity Bank now serves over 8.5 million customers through 255 business offices across Nigeria and the United Kingdom, complemented by comprehensive digital banking channels.

-

SME Support:

The bank is set to launch an innovative SME Hub with Creative Studios, aiming to provide tailored support and resources to small and medium-sized enterprises.

Regulatory Compliance:

-

Data Privacy Fine:

In August 2024, the Nigeria Data Protection Commission fined Fidelity Bank approximately $358,580 for alleged data privacy violations. The bank disputes these claims and is in discussions with the commission for an amicable resolution.

Overall, Fidelity Bank Plc demonstrates resilience and growth, focusing on capital enhancement, customer expansion, and support for SMEs, while addressing regulatory challenges proactively.

Services Offered by Fidelity Bank Plc

Fidelity Bank Plc provides a wide range of financial services to individuals, businesses, and corporate organizations. Below is a breakdown of their key offerings:

Personal Banking

- Savings & Current Accounts – Various account options tailored for everyday banking.

- Loans & Credit Facilities – Personal loans, salary advances, and mortgage financing.

- Fidelity Debit & Credit Cards – Visa, Mastercard, and Verve cards for payments and withdrawals.

- Fixed Deposits & Investments – High-interest savings and fixed-term investments.

SME Banking

- Business Accounts – Specialized accounts for small and medium-sized enterprises.

- SME Loans & Credit Lines – Financing solutions for business expansion.

- Trade & Export Finance – Support for local and international trade transactions.

- Business Advisory & Capacity Building – Training and mentorship programs for SMEs.

Corporate & Commercial Banking

- Corporate Finance & Investment Banking – Structured financial solutions for large businesses.

- Treasury & Cash Management – Efficient fund management services.

- Project & Infrastructure Finance – Funding for large-scale development projects.

- Foreign Exchange (FX) & Trade Services – Forex trading, trade finance, and import/export support.

Digital & Online Banking

- Fidelity Mobile App – Secure banking on the go.

- Internet Banking – Online banking for transactions, bill payments, and account management.

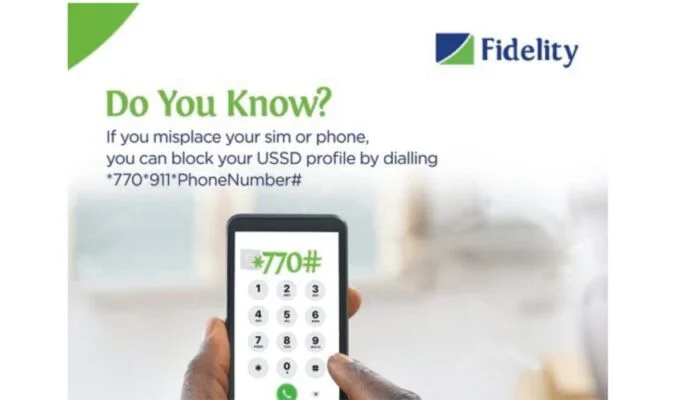

- *USSD Banking (770#) – Quick banking without internet access.

- ATM & POS Services – Nationwide network for cash withdrawals and payments.

Private Banking & Wealth Management

- Exclusive Banking Services – Personalized banking for high-net-worth individuals.

- Investment & Asset Management – Wealth-building solutions.

- Estate Planning & Trust Services – Advisory on asset protection and succession planning.

Financial Inclusion & Agency Banking

- Fidelity Bank Agent Banking – Brings banking services to rural and underserved areas.

- Microloans & Low-Cost Accounts – Affordable financial products for low-income earners.

Fidelity Bank Plc’s Commitment to Innovation

Fidelity Bank Plc is committed to leveraging technology and innovation to enhance banking services, improve customer experience, and drive financial inclusion. Below are some key areas where the bank is demonstrating its commitment to innovation:

Digital Banking & Fintech Integration

- Fidelity Mobile App – A secure, user-friendly app for seamless transactions.

- Internet Banking – Online access for funds transfers, bill payments, and account management.

- *USSD Banking (770#) – Quick banking for airtime purchase, money transfers, and bill payments without internet access.

- Chatbot & AI-powered Services – 24/7 customer support through intelligent virtual assistants.

SME Hub & Business Support Innovation

- Launched an SME Hub with Creative Studios to provide training, business development support, and funding access for entrepreneurs.

- Customized financial solutions for SMEs, including loans, advisory services, and e-commerce integration.

Example: The Fidelity SME Funding Program has helped over 3,000 small businesses access capital and scale their operations.

Artificial Intelligence (AI) & Data-Driven Banking

- AI-driven customer insights and predictive analytics to offer personalized banking experiences.

- Automated loan approvals and credit scoring models for faster loan disbursement.

- Fraud detection systems that enhance security and protect customer data.

Example: Fidelity Bank uses AI-powered chatbots to assist customers in real time.

Blockchain & Digital Currency Exploration

- Exploring blockchain technology for secure transactions and financial transparency.

- Support for eNaira (Nigeria’s digital currency) to enhance digital payments.

Example: Fidelity Bank is among Nigerian banks supporting eNaira adoption for seamless transactions.

Green Banking & Sustainability Innovation

- Eco-friendly banking initiatives, such as paperless transactions and energy-efficient branches.

- Green loan products to support businesses investing in sustainable projects.

Example: The bank finances renewable energy startups and businesses focusing on sustainability.

Cybersecurity & Digital Trust

- Multi-layer security measures for online banking.

- End-to-end encryption and biometric authentication for mobile banking users.

- Regular cybersecurity awareness campaigns to educate customers on fraud prevention.

Example: Fidelity Bank was recognized for its robust cybersecurity framework in Nigeria’s banking sector.

Summery

Fidelity Bank Plc has come a long way since its founding in 1988, evolving from a merchant bank to a leading commercial bank in Nigeria. Through strategic mergers, digital innovation, and a focus on customer satisfaction, the bank has established itself as a trusted financial partner for individuals, businesses, and institutions.

As Fidelity Bank continues to grow and adapt to the changing needs of its customers, it remains committed to driving financial inclusion, supporting economic development, and delivering value to its stakeholders. With its strong foundation and forward-looking approach, Fidelity Bank is well-positioned to maintain its leadership in Nigeria’s banking industry for years to come.

Business Amenities

- Accepts Debit Cards

- Car Parking

- Security Cameras

Contact Information

Opening Hours

Contact Business

Contact Business

Additional Information

Additional info

Subscribe now to get direct updates

Join Naijadirectory Newsletter