- Government Organisation

- 1034 Mohammadu Buhari Way, Garki, Abuja 900103, Federal Capital Territory, Nigeria

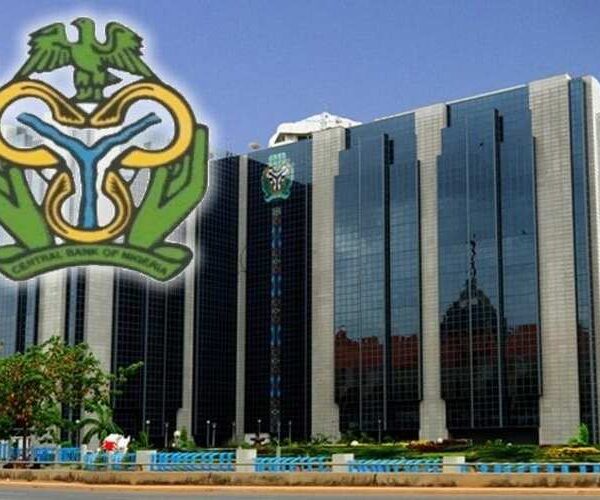

CENTRAL BANK OF NIGERIA (CBN)

History

The Central Bank of Nigeria (CBN) was established in 1958 and commenced operations on July 1, 1959, replacing the West African Currency Board (WACB). Its creation was part of Nigeria’s transition to full independence from British colonial rule, aiming to assert national sovereignty over monetary policy and currency issuance. Since its inception, the CBN has evolved to become the primary institution responsible for monetary management and financial regulation in Nigeria.

Functions and Responsibilities:

- Monetary Policy Formulation and Implementation: The CBN is tasked with formulating and implementing monetary policies to achieve macroeconomic objectives such as price stability, full employment, and sustainable economic growth. It employs various tools, including open market operations, reserve requirements, and interest rate adjustments, to influence the money supply and credit conditions.

- Currency Issuance and Management: As the sole issuer of legal tender currency in Nigeria, the CBN is responsible for printing and distributing banknotes and coins. It ensures the integrity and security of the currency in circulation, combats counterfeiting, and manages the country’s currency reserves to support domestic and international transactions.

- Banking Supervision and Regulation: The CBN regulates and supervises banks, microfinance institutions, and other financial institutions to maintain the stability and soundness of the financial system. It sets prudential regulations, conducts on-site examinations, and intervenes in troubled institutions to safeguard depositors’ funds and maintain public confidence in the banking sector.

- Payment System Oversight: Overseeing the payment systems is a crucial function of the CBN. It ensures the efficiency, safety, and reliability of payment mechanisms, including electronic fund transfers, card payments, and clearing and settlement systems. By promoting the adoption of modern payment technologies and standards, the CBN facilitates secure and convenient financial transactions.

- Development Finance Initiatives: The CBN plays an active role in promoting economic development and financial inclusion through various intervention programs and initiatives. These include targeted lending schemes such as the Anchor Borrowers’ Program, which supports agriculture and rural development, as well as funding initiatives for small and medium-sized enterprises (SMEs) and priority sectors like manufacturing and healthcare.

- Foreign Exchange Management: Managing Nigeria’s foreign exchange reserves and regulating the foreign exchange market is another key responsibility of the CBN. It intervenes in the market to stabilize the exchange rate, ensure an adequate supply of foreign currency, and support external trade and investment. Additionally, the CBN implements policies to manage capital flows and mitigate exchange rate volatility.

Organizational Structure

The CBN is governed by a Board of Directors comprising executive and non-executive members, including the Governor, Deputy Governors, and representatives from various sectors of the economy. The Governor, appointed by the President of Nigeria with the Senate’s approval, serves as the chief executive officer and is responsible for the bank’s administration and policy implementation. The CBN’s operations are divided into departments and units responsible for specific functions, including monetary policy, banking supervision, currency operations, and economic research.

Challenges and Initiatives

Despite its significant role in Nigeria’s economy, the CBN faces various challenges, including inflationary pressures, banking sector vulnerabilities, and external economic shocks. To address these challenges, the bank has introduced several initiatives and policy measures aimed at enhancing monetary stability, promoting financial inclusion, and supporting economic diversification.

These initiatives include the Cashless Policy, the National Financial Inclusion Strategy, and the Recapitalization of Banks to strengthen the banking system and stimulate credit growth.

Central Bank Act, 1958

The Central Bank Act, 1958 (as amended), and the Banking Decree 1969 (as amended) constituted the legal framework within which the CBN operates and regulates banks. The wide range of economic liberalization and deregulation measures following the adoption, in 1986, of a Structural Adjustment Programme (SAP) resulted in the emergence of more banks and other financial intermediaries.

The Banks and Other Financial Institutions (BOFI) Decrees 24 and 25 of 1991, which repealed the Banking Decree 1969 and all its amendments, were, therefore, enacted to strengthen and extend the powers of CBN to cover the new institutions to enhance the effectiveness of monetary policy, regulation and supervision of banks as well as non-banking financial institutions.

Unfortunately, in 1997, the Federal Government of Nigeria enacted the CBN (Amendment Decree No. 3 and BOFI (Amended)] Decree No. 4 in 1997 to remove the limited autonomy that the Bank enjoyed since 1991.

The 1997 Amendments

The 1997 amendments brought the CBN back under the supervision of the Ministry of Finance. The Decree made CBN directly responsible to the Minister of Finance concerning the supervision and control of banks and other financial institutions while extending the supervisory role of the bank to other specialized Banks and Financial Institutions.

The amendment placed enormous powers on the Ministry of Finance while leaving the CBN with a subjugated role in the monitoring of the financial institutions, leaving little room for the Bank to exercise discretionary powers.

The 1998 Amendments

The CBN (Amendment) Decree No. 37 of 1998, which repealed the CBN (Amended) Decree No. 3 of 1997,. The Decree provided a measure of operational autonomy for the CBN to carry out its traditional functions and enhanced its versatility.

The CBN Act, 2007

The current legal framework within which the CBN operates is the CBN Act of 2007 which repealed the CBN Act of 1991 and all its amendments. The Act provides that the CBN shall be a fully autonomous body in the discharge of its functions under the Act and the Banks and Other Financial Institutions Act with the objective of promoting stability and continuity in economic management.

In line with this, the Act widened the objectives of the CBN to include ensuring monetary and price stability as well as rendering economic advice to the Federal Government.

The BOFI (Amendment) Decree, 1998

Furthermore, the regulatory powers of the CBN were strengthened by Banks and other Financial Institutions (Amendment) Decree No. 38 of 1998 which repealed BOFI (Amendments) Decree No. 4 of 1997.

Through the amendments, the CBN may vary or revoke any condition subject to which a license was granted or may impose fresh or additional conditions to the granting of a license to transact banking business in the country.

By the Decree, the CBN’s powers on banks, specifically those relating to the withdrawal of licenses of distressed banks and appointment of liquidators of these banks, including the NDIC were restored.

The 1999 Amendment

The BOFI (Amendment) Decree No. 40 of 1999 makes the provisions relating to failing banks applicable to other financial institutions. It also empowers the Governor of the CBN to remove any manager or officer of a failing bank or other financial institution.

The Money and Capital Markets

The CBN has also taken responsibility for nurturing the money and capital markets. In furtherance of this, the CBN introduced treasury bills in 1960, a treasury certificate in 1968, and facilitated the establishment of the Lagos Stock Exchange in 1961 and the capital issue committee now known as the Securities & Exchange Committee in the early 1970s.

Department

In March 2010, the Central Bank of Nigeria launched its restructuring program tagged Project ACE with a view to repositioning and reinventing CBN for sustainable improvement of overall Accountability, Communication, Efficiency, and Effectiveness

The imperative for change was anchored on the CBN’s recognition of the need to gear up its systems and organization for strategic and business effectiveness issues. To ensure efficiency and effectiveness, and also to enhance smooth communication between and among departments, a new Management Structure was also put in place to drive this Change.

There are 29 (Twenty-Nine) Departments in the Central Bank of Nigeria grouped in order of related performance and job descriptions (JDs) to facilitate smooth operations and management of that department.

The formation of these directorates also reduces the pressure that would have been brought to bear on the chief executive (the Governor, CBN). Each directorate is headed by a deputy governor (D/G).

Management Approved the Establishment of 5 (five) Directorates:

- Corporate Services Directorate

- Economic Policy Directorate.

- Financial System Stability Directorate

- Governors’ Directorate

- Operations Directorate

In Summary

The Central Bank of Nigeria plays a pivotal role in maintaining monetary stability, regulating the financial sector, and supporting economic development in Nigeria. Through its diverse functions and initiatives, the CBN contributes to fostering a conducive environment for sustainable growth, financial inclusion, and overall economic prosperity.

Business Amenities

- Car Parking

- Funding: Federal

-

Government Owned

Government Owned

Contact Information

Opening Hours

Contact Business

Contact Business

Additional Information

Additional info